2025 Budget Summary - Impact on tax, savings, and property

Reflections on the Budget

Budget reflections: This year’s budget was delivered under an OBR induced cloud when it confessed that, “a link to our economic and fiscal outlook document went live on our website too early this morning. It has been removed. We apologise for this technical error and have initiated an investigation into how this happened. We will be reporting to our Oversight Board, the Treasury, and the Commons Treasury Committee on how this happened, and we will make sure this does not happen again”. This meant a miffed chancellor standing up to deliver her second budget, much of which was already in the public domain!

The big picture: The 2025 budget will look to raise £30 billion of additional tax by the year 2030/31 but the strange part is how much these tax rises are “backloaded” towards the end of this parliament and indeed into the next parliamentary term. One possible explanation is that many of the new taxes announced will take time to work through the system. For example, tax thresholds that were already frozen until 2028. This chart below tracks the tax increases for each year until 2030-31.

Source: Tax Policy Associates

Dates for your diary:

Tax Thresholds: Although the chancellor once again kept the headline rates of income Tax, National Insurance and VAT unchanged she did, as was widely expected freeze the personal tax and national insurance thresholds until 2030/31. Tax thresholds by this point would have been frozen for almost a decade. Fiscal drag has seemingly morphed into the world of “fiscal creep.” The upshot of this announcement is that more people with lower income will be bitten by tax and more will also be paying higher rates of tax. According to the Institute of Fiscal Studies by 2030–31 the freeze in thresholds brings 5.2m more into income tax – 700,000 more than in 2027–28 and 4.8m more into higher rate tax ,1.0m more than in 2027–28.

Source: Tax Policy Associates

Again, as was expected the Chancellor made no attempt to deal with the cliff edge of individuals losing their personal allowance once income creeps above £100,000.

What has not changed:

The 0% starting rate will remain at £5,000

The personal savings allowance remains unchanged at £1,000 for basic taxpayers and £500 for higher rate taxpayers

Additional rate taxpayers are not eligible for the personal savings allowance

The dividend allowance remains at £500

Investment income: We have seen the tax rates on dividends, property, and savings income by increase by 2 percentage points.

Property income: The government will create separate tax rates for property income. From 6 April 2027-28, the property basic rate will be 22%, the property higher rate will be 42%, and the property additional rate will be 47%. In terms of how this change impacts Scotland and Wales, “the government will engage with the devolved governments of Scotland and Wales to provide them with the ability to set property income rates in line with their current income tax powers in their fiscal frameworks.”

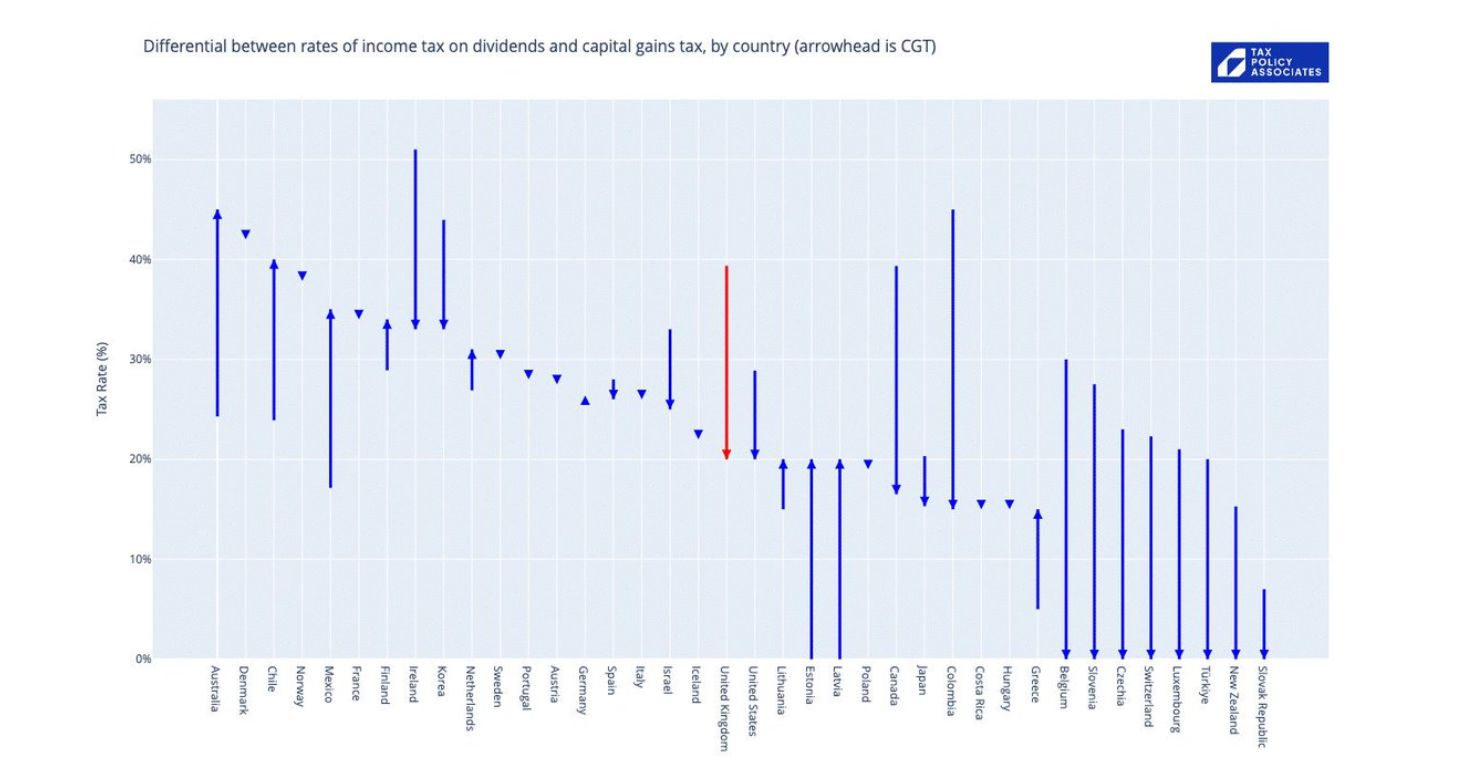

Dividend income: The government is changing the rates of income tax applicable to dividends. From 6 April 2026, the ordinary rate will be increased by 2 percentage points to 10.75% and the upper rate will be increased by 2 percentage points to 35.75%. The additional rate will remain unchanged at 39.35%. A further chart from Tax Policy Associates shows that even before these changes, the tax paid on dividends in the UK, was one of the highest in the world.

Source: Tax Policy Associates

Savings income: The government is changing the rates of income tax applicable to savings income. From 6 April 2027, the savings basic rate will be increased by 2 percentage points to 22%, the savings higher rate will be increased by 2 percentage points to 42% and the savings additional rate will be increased by 2 percentage points to 47%.

For the tax geeks amongst is the Treasury is also changing income tax rules so that reliefs and allowances deductible at steps 2 and 3 of the income tax calculation will only be applied to property, savings, and dividend income after they have been applied to other sources of income this will take effect from 6 April 2027.

Individual Savings Accounts (ISAs): Keeping broadly on the theme of savings, Rachel Reeves made the anticipated changes to the ISA regime with a slight twist when she announced that from 6 April 2027 the amount of money that can be saved tax-free each year in a cash ISA will be reduced from £20,000 to £12,000 a year for the under 65s. Over 65s will maintain the current £20,000 allowance. This means an individual can put £12,000 in cash and £8,000 in shares.

This is the nudge long trailed of encouraging people to invest more in stocks and shares ISAs and only impacts new money being saved from 6 April 2027, it does not impact money already in an ISA. The annual subscription limits remain at £20,000 for a stocks and shares ISAs, £4,000 for Lifetime ISAs and £9,000 for junior ISAs. These allowances are frozen at these levels until 5th April 2031.

Lifetime ISAs: A product that is increasingly feeling outdated and the government is set to publish a consultation in early 2026 on introducing a new, simpler (hopefully) ISA product to support first-time buyers. Once in place the Lifetime ISA, I suspect will be quietly retired.

Venture Capital Trusts (VCTs): The rate of VCT income tax relief will be reduced from 30% to 20% as from the 6th April 2026. Although the level of relief for investors in VCTs has been reduced there are measures in the budget that are designed to encourage entrepreneurship.

The existing annual, lifetime and gross assets limits for companies receiving investment under the EIS or VCT scheme will be increased as follows:

The gross assets limits that a company receiving investment under the EIS or VCT scheme must not exceed will be increased to £30 million (from £15 million) immediately before the issue of the shares or securities, and £35 million (from £16 million) immediately after the issue

The annual investment limit that companies can raise through EIS / VCT investment will be increased to £10 million (from £5 million) and for knowledge-intensive companies to £20 million (from £10 million); and

The company’s lifetime investment limit would be increased to £24 million (from £12 million) and for knowledge-intensive companies to £40 million (from £20 million)

More details can be found here.

Inheritance tax: Moving onto inheritance tax (IHT), there seems to be no movement in the broad principle that unused pension funds and death benefits from April 2027 will be subject to IHT. However, in response to the significant grumblings from the legal profession as to how Personal Representatives are expected to deal with pension assets, the government has confirmed that “Personal representatives will be able to direct pension scheme administrators to withhold 50% of taxable benefits for up to 15 months and pay Inheritance Tax due in certain circumstances. Personal representatives will be discharged from liability for payment of Inheritance Tax on pensions discovered after they have received clearance from HMRC. This will be legislated for in Finance Bill 2025-26 and take effect from 6 April 2027.”

Additionally, the chancellor has relented and will allow for Agricultural Property Relief and Business Property Relief any unused allowance for the 100% rate of relief to be transferable between spouses and civil partners from 6 April 2026.

Also, on a positive note the government has confirmed that for individuals impacted by the Infected Blood Compensation Scheme, the legislation will be updated to implement several recommendations which include all payments from the blood transfusion scandal being exempt from inheritance tax regardless of the circumstances in which those payments are passed down.

Leaving IHT on a gloomier note the thresholds for the inheritance tax nil- rate bands that are already set at current levels until April 2030 and will stay fixed at these levels for a further year until April 2031. The forthcoming combined allowance for the 100% rate of agricultural property relief and business property relief will also be fixed at £1 million for a further year until 5 April 2031.

Trust taxation: The increases in tax on property income and savings income arising to additional rate taxpayers (47%) from the 6 April 2027 will also apply to property rental and savings income (interest) received by the trustees of discretionary trusts.

For trustees of interest in possession (IIP) trusts who receive property and/or savings income, and which is not mandated directly to the IIP beneficiary will pay from the 6th April 2027 tax at 22%.

Pensions: The Chancellor went out of her way in her speech to confirm that she would not be making any changes to pensions tax relief or to tax- free cash but did announce changes to the salary sacrifice rules for pension contributions. From 6 April 2029, the government will charge employer and employee NICs on pension contributions above £2,000 per annum. That is still three years away and a significant amount of tax-efficient pension saving can still happen between now and then. That said this measure impacts middle to higher earners. In particular, individuals in and around £100,000 will feel the pain.

With regards to the triple lock on the state pension, this (for the moment) remains in place. The basic and new State Pension will be increase by 4.8% from April 2026, in line with earnings growth, meaning over 12 million pensioners will gain up to £575 each in 2026-27. The Pension Credit Standard Minimum Guarantee will also be uprated by 4.8% from April 2026.

The government has said that pensioners whose sole income is the state pension will not have to pay small amounts of tax for breaching the personal allowance. “The government will ease the administrative burden for pensioners whose sole income is the basic or new state pension without any increments so that they do not have to pay small amounts of tax via Simple Assessment from 2027-8 if the new or basic state pension exceeds the personal allowance from that point.” The government is exploring the best way to achieve this and will set out more detail next year.

Property Taxes: Earlier in this piece we talked about cliff edges, and we will see yet more of these with the announcement of a “mansion tax” on high value properties. The bones of the policy are that from 6 April 2028 owners of properties identified as being valued over £2m by the Valuation Office (in 2026 prices) will be liable for a recurring annual tax charge over and above their existing council tax liability. There will be four price bands with the surcharge rising from £2,500 for a property valued in the £2m to £2.5m band, to £7,500 for a property valued in the highest band of £5m or more. These thresholds will be uprated in line with CPI each year.

According to the BBC, this measure will be levied on about 100,000 properties, primarily in London and southeast England and the move will require the valuation of homes in the top council tax bands - F, G and H - for the first time since 1991. The design of this “high value council tax surcharge” could cause problems in time with “bunching” of properties in and around these thresholds and we may also see more “downsizing”, also valuations may wobble at the top end as the market works out how to discount the mansion tax payable on a property and how this feeds into the sale price. In terms of the additional revenue raised local authorities will collect this revenue on behalf of central government. Revenue will be used to support funding for local government services.

Written by: David Lane

Partner & Technical Director

LGT Wealth Management UK LLP