We are constantly being reminded to save money for retirement, but just how much should we be saving?

There has been a big push by the government recently to get more people planning their retirement and the introduction of the Lifetime Isa (which yields a massive interest rate of 25%) shows their commitment to getting people to save.

Maintaining Standards

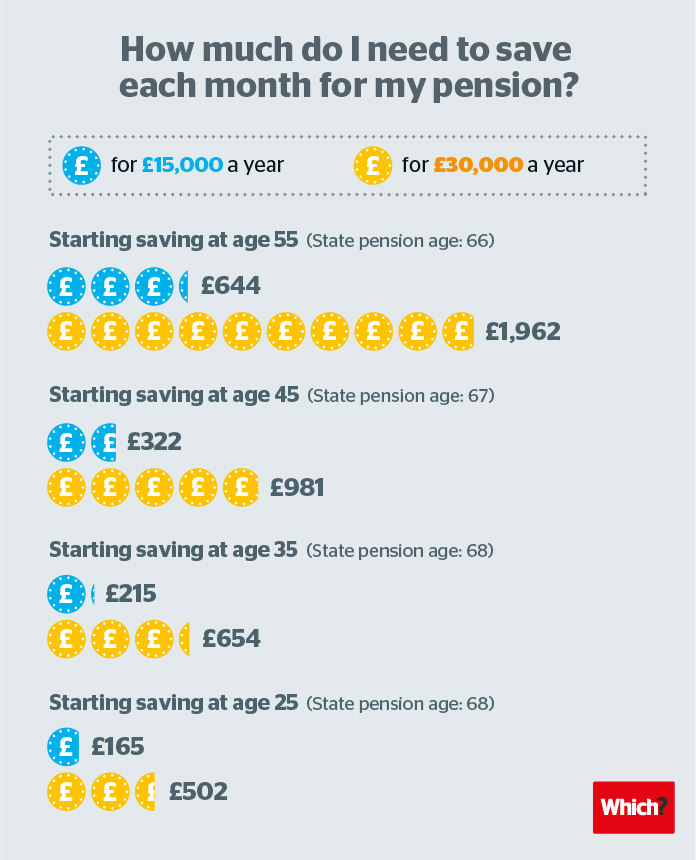

It has been estimated that those retiring in 2050 will need £660,000 in their pension pot to maintain the level of living standards that current retirees are experiencing at the moment. Which? has also calculated the amount that people need to save in order to take a pension of £15,000 per year and £30,000 per year. The infographic below shows how much you need to put into a pension per month and at which age…

The figures are projected assuming it is invested in income drawdown, will grow at 6% per year and being drawn down to zero 20 years after retirement. It also assumes that life expectancy from 65 is 19 years for men and 21 years for women.

We took a look at the case for saving into a pension as early as possible in an earlier blog post, and dispelled some of the myths surrounding pensions which may deter people from saving early.